I was supposed to be a doctor. At least that’s what my maternal grandmother wanted and asked for every day we spent together. Instead I’m an investment consultant, advising institutions on money matters. I’ve been in the field my entire career and always felt as if it were a natural thing for me to do. After spending a couple of weeks with my grandmother, I now suspect I have been genetically programmed.

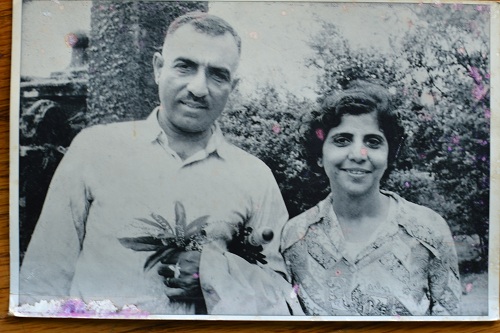

To understand my conclusion, I need to tell you a little about my Nani. When she graduated high school she declared she wanted to be a doctor. Her parents refused, insisting marriage and a career were mutually exclusive and they wanted her married. In defiance, she refused to attend college at all, instead focusing her time on playing tennis, the piano and getting into stocks and bonds. Now 97, Nani eagerly awaits the morning paper to track her investments. Her eyesight is so bad that the tickers blob together, but somehow by the end of the morning she knows where things stand. She may not have a college degree, but the skill she has in growing money rivals the abilities I’ve gained from any degree or credential.

The investment field is full of supposed oracles, theories and guides. Nani doesn’t have too much to add to that mix, but she certainly exemplifies what many investors preach but don’t practice.

First, invest for the long term. And I mean really long term. Nani talks about stocks she’s held for 30 years as if they are my cousins. She knows these companies inside out. This morning she was grilling us about Honda – what’s their newest model? Why did they choose to name the car Brio? Is it really going to sell in India? This commitment allows her to fully understand what she’s investing in and the ability to know whether a company is changing for the better.

Second, don’t get too fancy. In true Warren Buffett fashion, Nani only invests in things she understands. She gets industries, consumer goods and health care She found out we just got our typhoid shots, which were manufactured by GSK. She launched into a long description of every drug and product it makes. By contrast, she still has to grasp the concept of a computer so technology doesn’t play much of role in her portfolio. However, this afternoon Ava and Kayan decided to unload their toy box onto Nani’s lap. Then Kayan moved onto his daily fill of the iPad. She observed Kayan for a while and then asked, “Diya, who makes that computer?”

Third, invest in people. India may have over a billion people, but I think there is only three degrees of separation between us. If Nani doesn’t know the top management of the companies she owns, she makes it a point to find someone who can give her insight. She’s a strong believer in integrity and hard work and wants to make sure the people in charge of her money hold the same values. Yesterday’s papers had a story about the succession plan for one of her largest holdings. After reading the article, Nani started on about man at the helm, who he had married, how he became a widow and the family he subsequently raised and trained to take over the business.

She may not have been a doctor, but she sure makes a good investor.